IT & Software: 2025 Q3 Market Landscape & Salary Insight Report

The T2M 2025 IT & Software Q3 Market & Salary Report is live, and it’s packed with insights you don’t want to miss.

T2M’s Head of IT, Sam Birtwistle, breaks down what’s really happening across the tech hiring landscape; from in-demand roles and salary shifts to what top talent is looking for.

Whether you’re a hiring manager, a worker debating whether it’s time to move, or are actively looking. This report breaks down exactly what’s going on in the market right now.

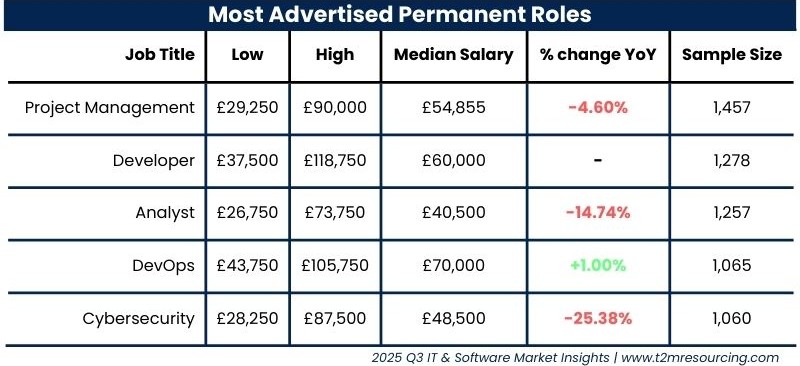

Across the most advertised permanent positions, salary performance has softened, with only DevOps showing a modest +1.0% year-on-year (YoY) increase to a median of £70,000. These trends reflect a broader market under pressure, with employers managing increased costs and showing more cautious hiring sentiment.

Contractor demand and pay have also moderated amongst the most advertised positions. DevOps continues to command the highest median day rate (£525), despite a 4.55% YoY decline. The REC’s contractor demand index for IT registered its third lowest score of the year in July, signalling ongoing caution in project-based hiring.

Tech Demand Remains Resilient, But Selective

While demand for roles in Big Data, FinTech, AI, and Software remains strong, employers are increasingly focused on specialist, high-value skills rather than volume hiring.

AI and automation in recruitment

Hiring teams are accelerating adoption of AI tools for screening, matching, and bias reduction, helping streamline processes but also shifting candidate expectations.

Confidence despite uncertainty

Chief executives are more upbeat about future growth prospects for their industry and the UK economy than might be expected. They are resilient and responding to challenges by adapting their investment strategies to focus on AI adoption, managing cyber risk and upskilling their talent.

Skills Shortages

Persistent gaps in AI, data, and cybersecurity continue to constrain hiring, with competition intensifying for top technical talent.

Cost Pressures

NI increases and inflationary overheads are impacting hiring budgets. Employers are balancing wage restraint with retention risks.

Employer Confidence, but with Hiring Caution

The REC and CPD both signal cautious optimism, with many organisations adopting a ‘wait-and-see’ approach on headcount expansion.

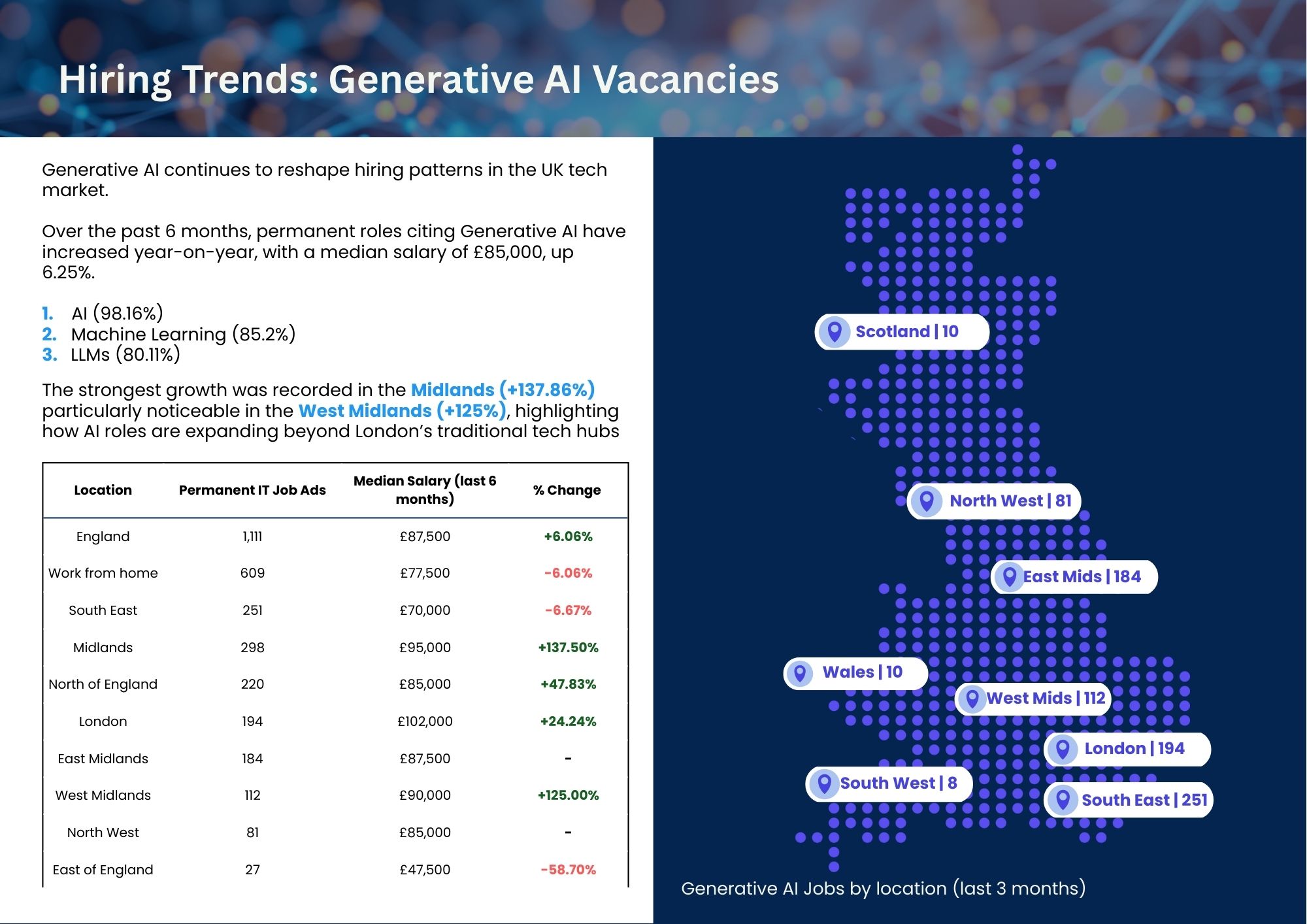

Generative AI continues to reshape hiring patterns in the UK tech market.

Over the past 6 months, permanent roles citing Generative AI have increased year-on-year, with a median salary of £85,000, up 6.25%.

1. AI (98.16%)

2. Machine Learning (85.2%)

3. LLMs (80.11%)

The strongest growth was recorded in the Midlands (+137.86%), particularly noticeable in the West Midlands (+125%), highlighting how AI roles are expanding beyond London’s traditional tech hubs.

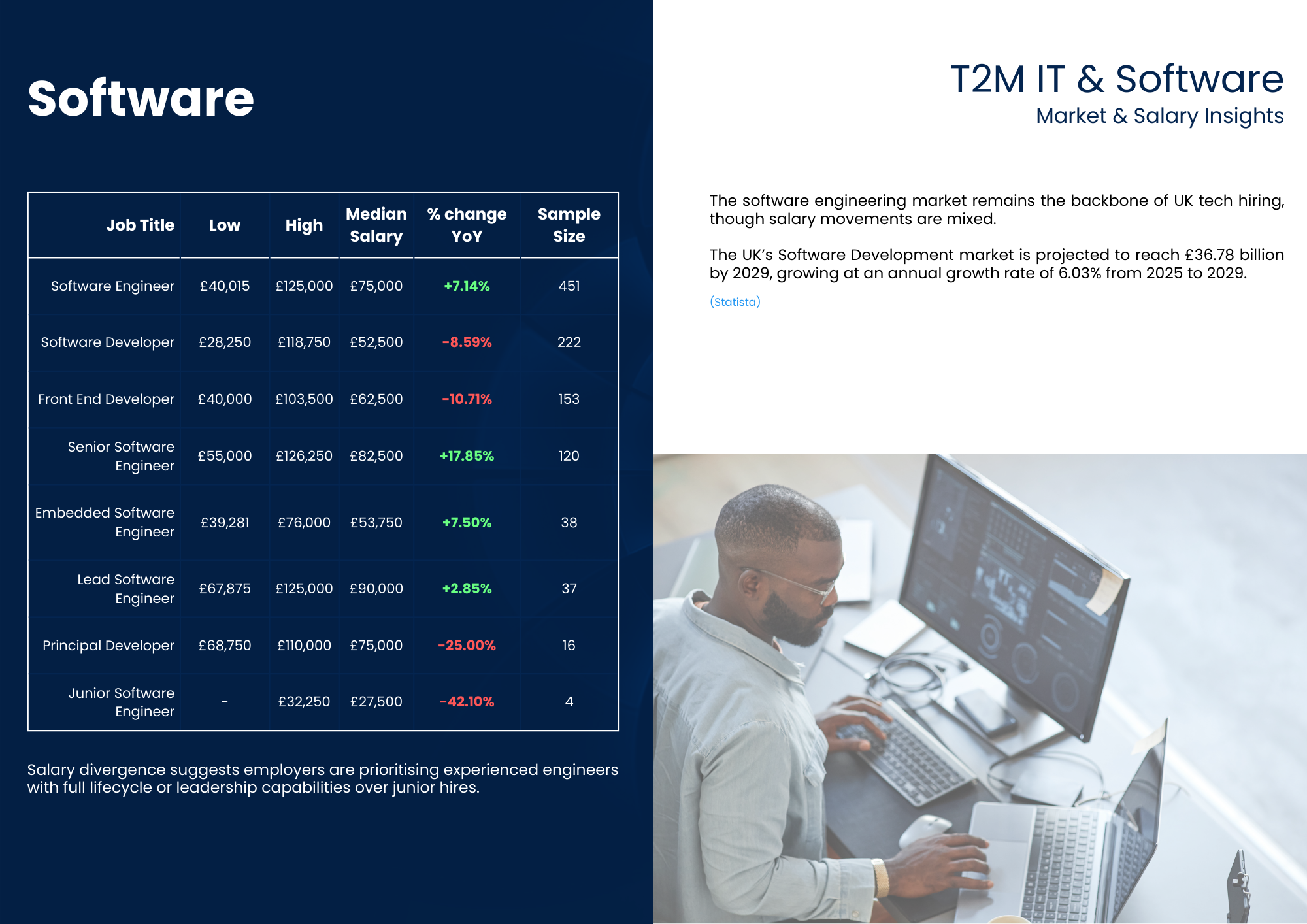

The software engineering market remains the backbone of UK tech hiring, though salary movements are mixed.

Salary divergence suggests employers are prioritising experienced engineers with full lifecycle or leadership capabilities over junior hires.

The UK’s Software Development market is projected to reach £36.78 billion by 2029, growing at an annual growth rate of 6.03% from 2025 to 2029.

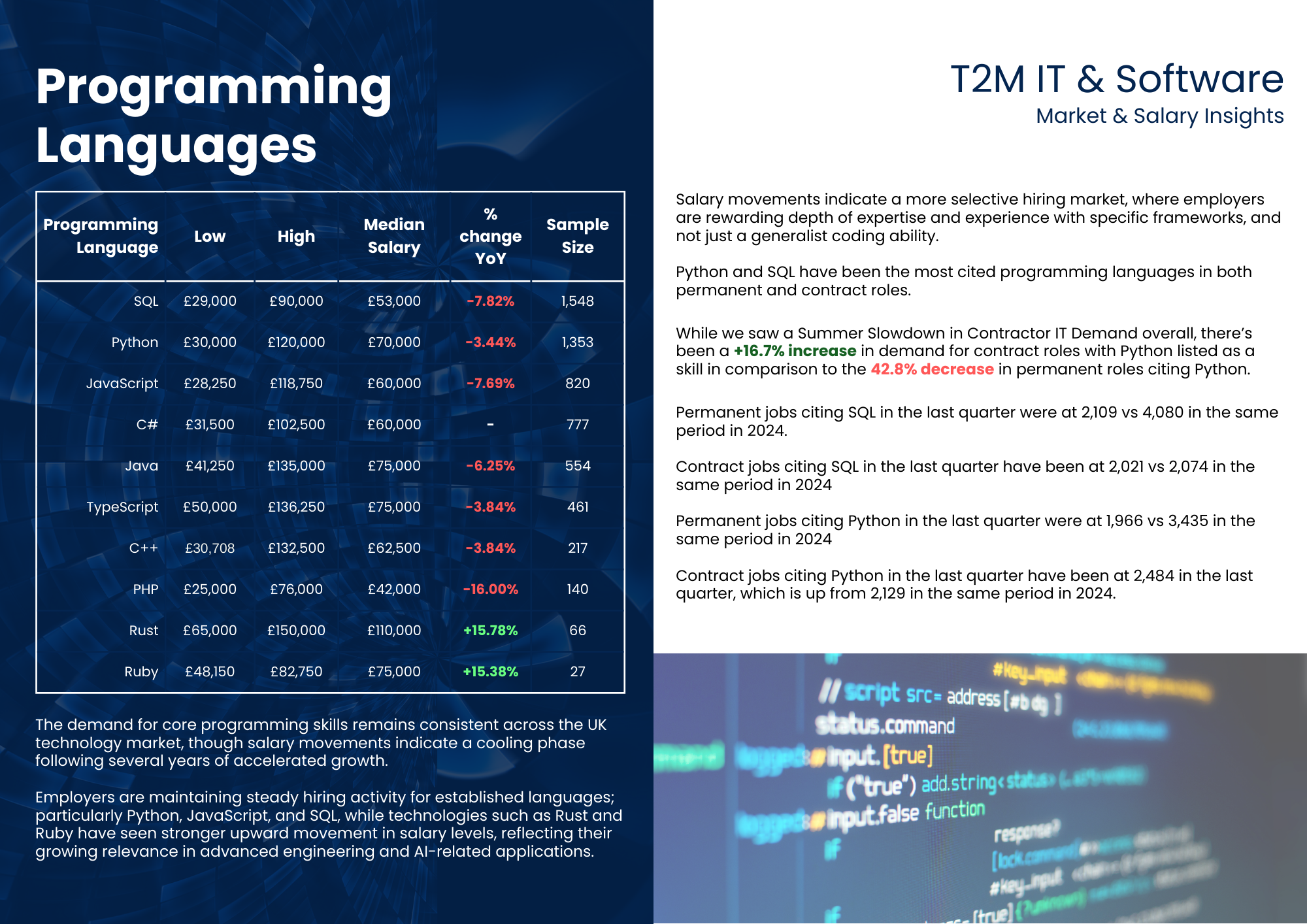

The demand for core programming skills remains consistent across the UK technology market, though salary movements indicate a cooling phase following several years of accelerated growth.

Employers are maintaining steady hiring activity for established languages; particularly Python, JavaScript, and SQL, while technologies such as Rust and Ruby have seen stronger upward movement in salary levels, reflecting their growing relevance in advanced engineering and AI-related applications.

Salary movements indicate a more selective hiring market, where employers are rewarding depth of expertise and experience with specific frameworks, and not just a generalist coding ability.

Python and SQL have been the most cited programming languages in both permanent and contract roles.

While we saw a Summer Slowdown in Contractor IT Demand overall, there’s been a +16.7% increase in demand for contract roles with Python listed as a skill in comparison to the 42.8% decrease in permanent roles citing Python.

Permanent jobs citing SQL in the last quarter were at 2,109 vs 4,080 in the same period in 2024.

Contract jobs citing SQL in the last quarter have been at 2,021 vs 2,074 in the same period in 2024.

Permanent jobs citing Python in the last quarter were at 1,966 vs 3,435 in the same period in 2024.

Contract jobs citing Python in the last quarter have been at 2,484 in the last quarter, which is up from 2,129 in the same period in 2024.

Cloud hiring remains steady, though salary movements suggest a period of correction following rapid growth between 2021–2023.

Employers are prioritising multi-cloud and automation expertise, particularly across AWS, Azure, and GCP; rather than broad infrastructure experience alone.

Businesses continue investing in resilience and automation, cloud professionals with DevOps and architecture skills will remain in high demand, even as compensation levels stabilise across the wider ecosystem

AI talent market remains one of the strongest within the UK tech ecosystem. Median salaries have risen across nearly all roles, led by significant gains for Data Scientists and Senior Data Scientists.

The Data, AI, and Machine Learning sector continues to experience exceptional growth as UK organisations prioritise data-driven decision-making and automation.

Demand for professionals skilled in analytics, AI model development, and data infrastructure remains strong, with most roles seeing notable year-on-year salary increases.

This upward trend reflects the strategic value of data and AI expertise in enhancing productivity, innovation, and competitiveness across industries.

The World Economic Forum reported that 88% of employers believe AI and Big Data skills will be of increasing in importance between 2025 to 2030.

Project and Business Consultants have maintained or improved their earnings potential, reflecting their strategic influence in guiding transformation initiatives. However, reductions across analytical and support positions suggest a tightening of budgets and increased expectations for measurable project impact.

As organisations focus on operational efficiency and digital transformation, demand for skilled delivery professionals remains steady.

Salary variation indicates organisations are prioritising hands-on expertise and modern security skill sets over traditional monitoring roles. Professionals with cloud-native security, automation, and offensive security skills remain best positioned for long-term demand.

The cybersecurity market remains critical to UK tech hiring, though salary shifts highlight changing demand. specialised areas such as PenTesting, DevSecOps, and Security Engineering experienced strong growth, reflecting employer focus on advanced technical capability and proactive threat reduction.

The infrastructure and support market shows mixed salary movement, with strong gains for Cloud and Infrastructure Engineers, driven by ongoing cloud adoption and hybrid network needs.

Traditional support roles saw modest to negative shifts, indicating continued prioritisation of automation, scalability skills, and cloud expertise over purely operational support functions.

Market movement reflects a clear preference for cloud-enabled and infrastructure-focused engineering roles, with reduced emphasis on traditional support positions.

Executive hiring remains stable with strong growth in strategic and technology-driven leadership roles, particularly Development and Technology heads. Salary uplift reflects increased demand for senior leaders guiding digital transformation, despite smaller sample sizes.